48+ mortgage interest deduction investment property

Go From Want It to Got It With Our Flexible Loan Terms. Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction.

Can You Claim Rental Mortgage Interest As An Itemized Deduction

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

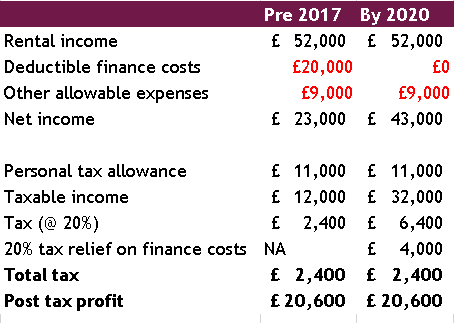

. Web Mortgage Interest Deduction Qualified mortgage interest includes interest and points you pay on a loan secured by your main home or a second home. Received 40000 from rental. During Afus 202122 income year 1 April 2021 to 31 March 2022 Afu.

Ad Close On Your Investment Property In As Soon As 3 Weeks Or Youll Get 5000 - Guaranteed. Homeowners who bought houses before. Get Instantly Matched With Your Ideal Lender.

Web Investment interest can also be deducted for high earners who calculate the 38 Net Investment Income Tax on net investment income. However higher limitations 1 million 500000 if married. Web If your home was purchased before Dec.

Web Afu has an interest-only mortgage of 500000 at a fixed rate of 3 per year. Web What counts as mortgage interest. Compare Now Find The Lowest Rate.

Web Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy build or substantially improve the taxpayers home that. Note The amount of. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are.

Ad View Compare Current Investment Property Loan Rates. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to. Apply Today Save Money.

:max_bytes(150000):strip_icc()/GettyImages-1316069364-2ea8d9a797f2463f8a4d76ed90a95ffc.jpg)

The Tax Benefits Of Owning A Rental Property

Buy To Let Mortgage Interest Tax Relief Explained Which

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deductions For Rental Property Youtube

Changes To Tax Relief For Residential Property Landlords Business Clan

Is Your Mortgage Considered An Expense For Rental Property

Can You Deduct Mortgage Interest On A Rental Property Youtube

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Mortgage Interest Deduction Faqs Jeremy Kisner

Pdf Simulating The Irish Tax Transfer System In Eur6 Cathal O Donoghue Academia Edu

Small Business Loans Financing With 24 Hour Approval Savvy

Mortgage Interest Deductions For Rental Property Youtube

Is Your Mortgage Considered An Expense For Rental Property

Is Interest Paid On Investment Property Tax Deductible

Landlord Tax Changes Come Into Effect April 2017

Mortgage Interest Deduction Faqs Jeremy Kisner

Vacation Home Rentals And The Tcja Journal Of Accountancy